AU IVY Program sets a new standard in premium banking, offering an unparalleled suite of privileges to elite clientele.

KRC TIMES Assam Bureau

KRC TIMES Assam Bureau

Guwahati : AU Small Finance Bank, India’s largest SFB, has announced the launch of all-new AU ivy program. Designed exclusively for High-Net-Worth Individuals (HNIs) and Ultra-High Net Worth Individuals (Ultra-HNIs), this opulent super premium banking program is a pinnacle of exclusivity, extended through personal invitations to a select group of discerning customers.

The AU ivy Program is meticulously tailored to cater to the sophisticated needs of distinguished individuals, including CXOs, top-tier professionals, and self-employed entrepreneurs, among others. This initiative is built upon the foundation of cultivating long-lasting relationships and providing a collection of exclusive banking experiences that resonate with the unique aspirations of this elite clientele.

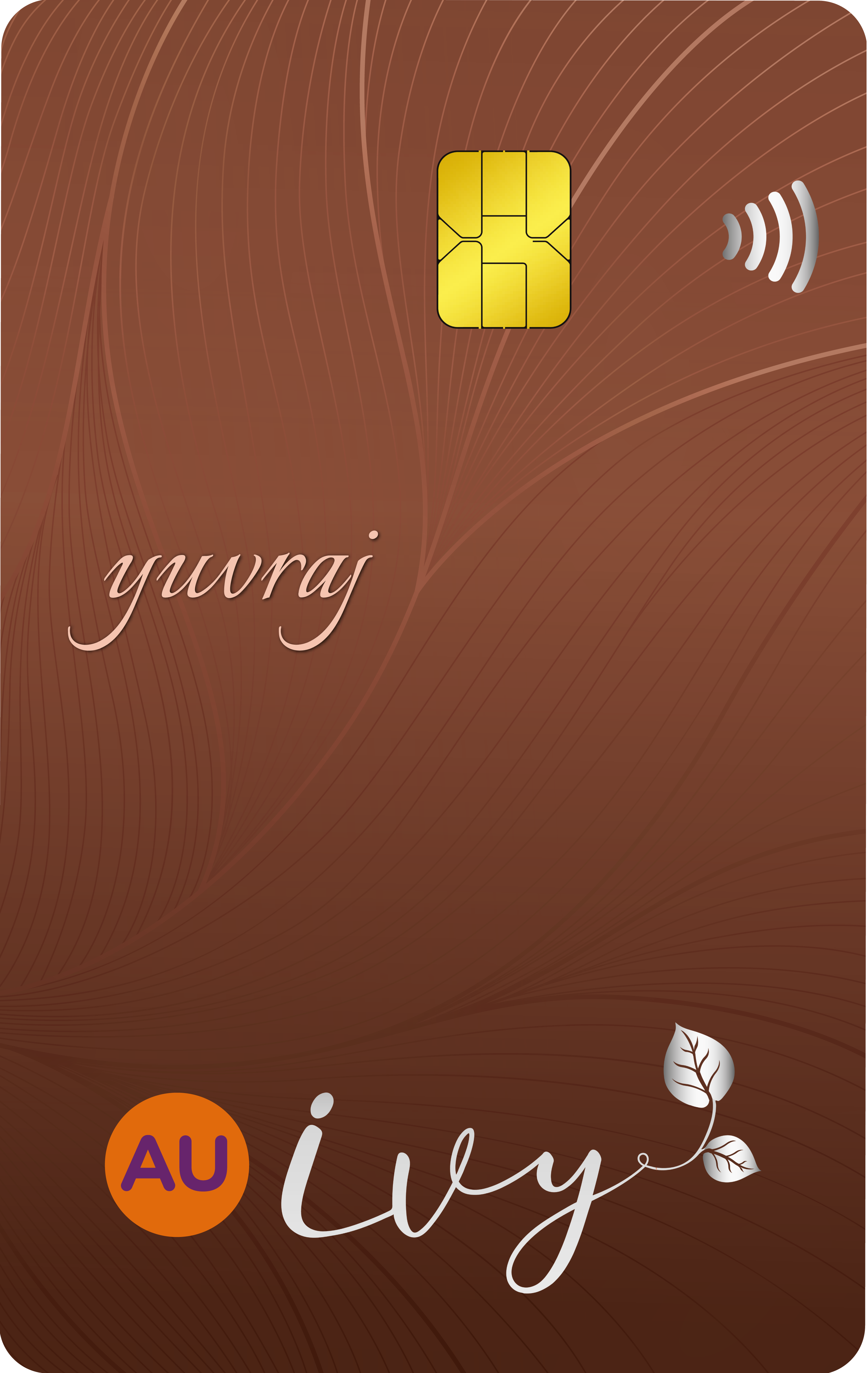

At the heart of the AU ivy Program lies its most distinguished feature – the ‘3-in-1 Metallic Debit Card.’ This card, built on the esteemed Visa Infinite platform, seamlessly integrates the functions of a debit, forex, and priority pass. It’s not just a card, but a gateway to a world of convenience and luxury. Offering a range of complimentary services and a ‘no charges” promise, the program stands as a testament to AU Small Finance Bank’s commitment to redefine banking experiences.

Key Features:

Zero Cross Currency Mark-up: Travelling abroad becomes seamless with ‘Zero Cross Currency Mark-up,’ eliminating additional charges on international transactions.

Unlimited Banking Convenience: AU ivy clients enjoy unlimited transactions across any bank’s ATM, as well as limitless cash deposit, withdrawal at branches, and digital payments.

Exclusive Locker Access: Members are granted two complimentary lockers of any size, offering secure storage for valuable possessions.

The value proposition of the AU ivy Program extends further along with reward program of 1% cashback on non-fuel expenses, making each purchase a rewarding experience. AU ivy transcends conventional banking models by offering an exquisite array of benefits aligned with the Total Relationship Value of the customer’s family with the bank.

New members are greeted with a specifically curated Taj Epicure Privileged Membership, opening doors to exclusive privileges at renowned hotels, fine dining establishments, spa treatments, and more.

“AU IVY isn’t just a banking program; it embodies distinction and sophistication,” stated Uttam Tibrewal, Executive Director of AU Small Finance Bank. “Our bank has consistently led the way in reshaping the banking experience through personalized services, innovative solutions, and an unwavering commitment to excellence.

The AU IVY Program introduces a new dimension, transcending traditional banking to deliver an extraordinary lifestyle curated to match the refined tastes and aspirations of our distinguished members.” Sujai Raina, Head – Business Development, Visa India said, “We are thrilled to partner with AU Small Finance Bank to power this super premium debit card that caters to the Bank’s high net worth and super affluent customers.

This exclusive proposition offers a perfect blend of a superior banking experience and premium lifestyle benefits including privileged access to premium hotels and other hospitality experiences, benefits on international travel and exclusive access to airport lounges and golfing privileges; all of this with the Visa promise of safe, secure and seamless transaction experience.”

The launch of the AU IVY Program cements AU Small Finance Bank’s dedication to offering an unparalleled level of service and exclusivity, tailored to the unique needs of its ultra-premium customers.