He asked the banks to be watchful on the lag between credit and deposit growth and advised that the former should not exceed the latter

KRC TIMES National Bureau

KRC TIMES National Bureau

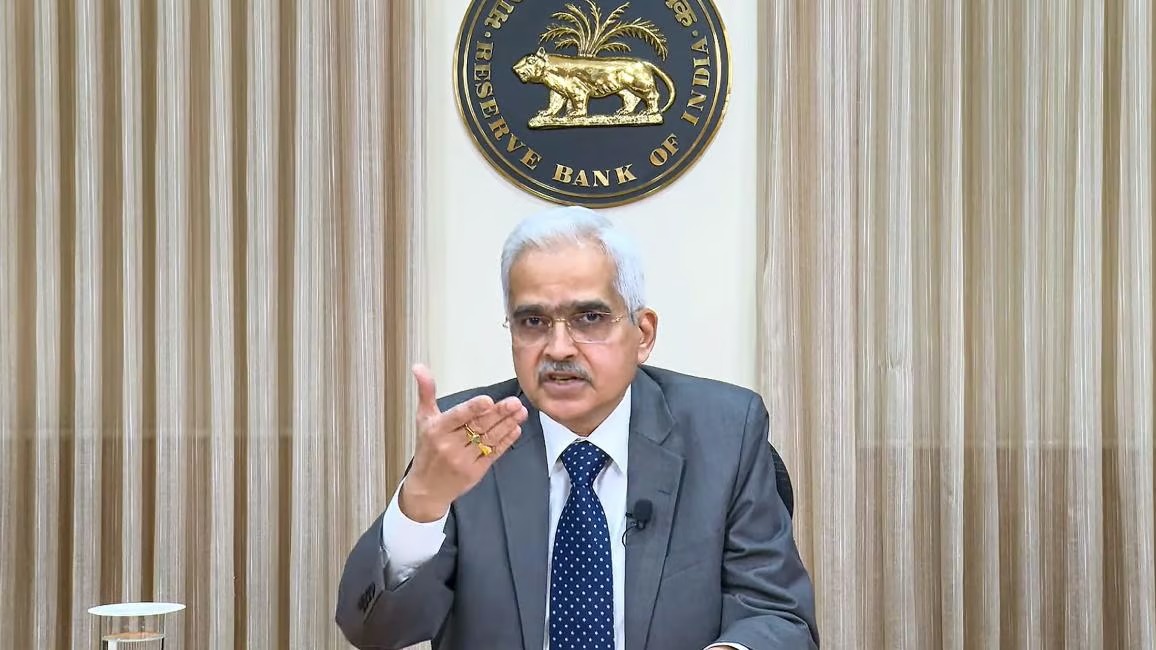

Mumbai : Governor Shaktikanta Das on Friday said the Reserve Bank’s relations with the government have been “smooth” during his nearly six-year term, and credited the close coordination between the two for the quick revival of the economy after the pandemic.

Speaking at an event organised by Financial Express here, the bureaucrat-turned-central banker said nobody has expected him to be a “cheerleader” for the government during his term.

“I am saying from my experience. Nobody expects RBI to be a cheerleader. I have had no such experience,” he said, responding to a specific question about a lament made by one of his predecessors in a recent book.

Asked if he is open for a new term at Mint Road, Das said he is very focused on the current assignment and does not think of anything outside that.

Das said the RBI is optimistic that its estimate of 7.2 per cent growth for FY25 will be met, and added that with steady growth, the focus of the policy has to be “clearly and unambiguously” on inflation. The inflation elephant is taking pauses and grudgingly moving towards the forest or the 4 per cent target in an unidirectional way, he added.

He asked the banks to be watchful on the lag between credit and deposit growth and advised that the former should not exceed the latter. The Governor also warned that the financial system can get exposed to “structural liquidity issues” due to the lag between the credit and deposit growth.

Amid concerns about Mule accounts being used by fraudsters, Das asked banks to strengthen their customer onboarding and transaction monitoring systems to check unscrupulous activities. The RBI is working with banks and law enforcement agencies to check Mule accounts and digital frauds, he added.

Das said RBI’s actions on the unsecured lending have had the desired impact and growth in the focus segment has moderated, but flagged concerns on the high ceilings on unsecured lending kept by some banks despite having high exposures already. He advised prudence to such banks and added that they should avoid exuberance.

In light of his comments on Friday, which are also preceded by some actions taken by RBI against some errant entities, Das clarified that no one should assume that there is a big problem with the banking system and added that it remains very stable and healthy.

The RBI is not looking at any proposal on allowing corporate entities to own or promote banks at present, Das said, adding that the issue of related party transactions is very real and having any control over them is difficult.

He said India does not need a proliferation of banks, but well-governed and stable institutions, he said, adding that the on-tap facility for universal bank licenses continues to be open for those qualifying as fit and proper.