Housing Minister Urges Authorities to Play a Positive Role to Ensure Protection of Livelihoods of Street Vendors

KRC TIMES Desk

KRC TIMES Desk

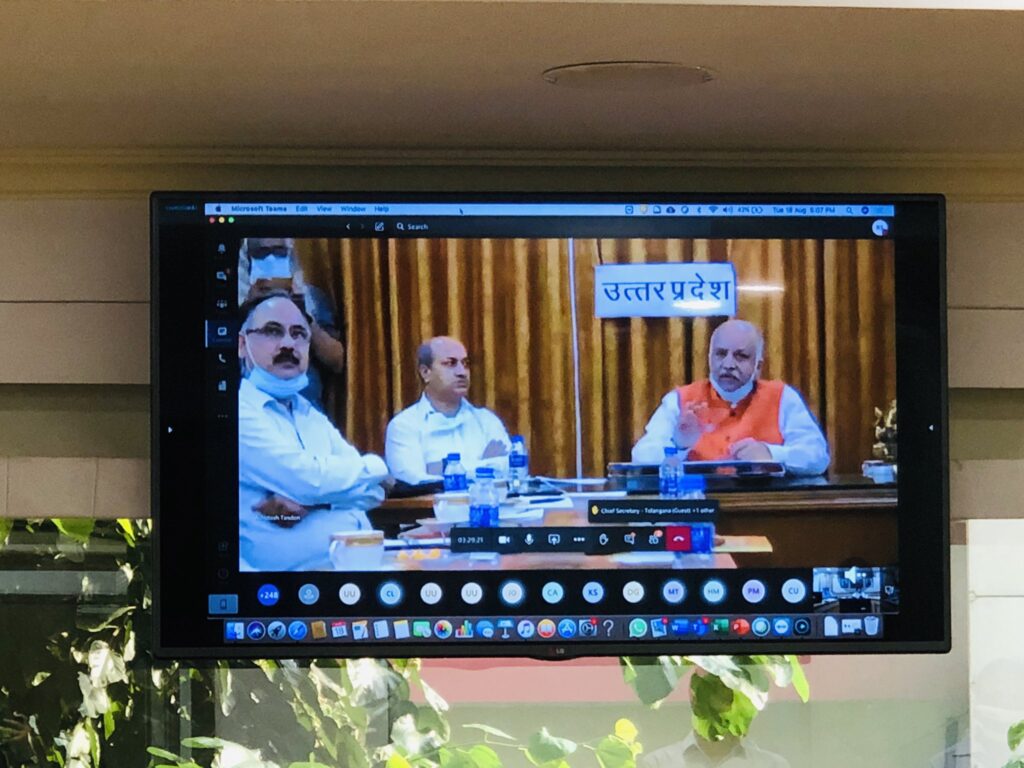

During a meeting with the Housing and Urban Development Ministers of state governments, Chief secretaries, State Principal Secretaries, DGP’s, Municipal Commissioners, Collectors, District Magistrates and other stakeholders held on 18 August to review PM SVANidhi scheme.

Hardeep Singh Puri, MoS, (I/C), Housing and Urban Affairs has urged them to sensitize all their subordinates towards the street vendors. “To a marginalized Street Vendor already battling to survive on a day to day basis, overturning his cart or asking for a bribe or any other form of harassment, is diabolically cruel. The Street Vendor is invariably neck-deep in debt already, with the stranglehold of unscrupulous money lenders tightening with the exorbitant rates of interest. Thus, when even a single act of harassment takes place, from the very Government, that he looks up to for deliverance, it is nothing but travesty” he added. Durga Shanker Mishra, Secretary, Mohua, Ajay Bhalla, Home Secretary and senior officers from all over the country were present in the virtual meeting.

With the launch of the PM SVANidhi scheme, for the first time, a serious effort is being made to free the Street Vendors from the vicious cycle of indebtedness. The Ministry is also in the process of preparing a plan to capture the socio-economic profile of all PM SVANidhi beneficiaries in order to facilitate their access to various government welfare schemes, as per their entitlements, said the Minister. During the meeting, Puri emphasized that even in normal times the Street Vendors have a marginalized existence and their plight has been compounded with the Covid-19 pandemic as even this marginalized existence is under threat. The minister stressed that the Street Vendors need to be provided with an enabling environment where they have a sense of protection from undue harassment/eviction. He added that it is the duty of all concerned authorities to make sincere efforts towards the achievement of the objective. He further said that the role of the police force and municipalities is important in the overall protection of livelihoods of street vendors and creating a conducive environment and added that the vendors do not demand much, other than a place where they can vend their articles in a harassment-free environment. “Street vendors constitute up to 2% of the urban population and they contribute immensely to the informal economy.

The minister informed that so far, over 5,70,000 loan applications have been received, out of which over 1,35,000 loans sanctioned and over 37,000 disbursed. “The scheme should not be just seen from the perspective for extending loans to street vendors but it should also be seen as a part of an outreach for their comprehensive development and socio-economic upliftment”, he said. The Ministry of Housing and Urban Affairs is implementing the Deendayal Antyodaya Yojana – National Urban Livelihoods Mission (DAY-NULM) which has provision for the creation of a pro-vending infrastructure in the Urban Local Bodies (ULBs) through the Support to Urban Street Vendors (SUSV) component. The Street Vendors Act, 2014 came into effect from May 2014 for protection of livelihood rights, social security and regulation of urban street vending.

Pointing out that the lockdowns in the wake of the COVID-19 pandemic, have adversely impacted the lives and livelihoods of Street Vendors, the minister said that to facilitate the working capital needs of Street Vendors, Government has launched PM SVANidhi, on June 01, 2020, under which the vendors can avail a collateral-free working capital loan of up to Rs. 10,000 and this loan is of 1-year tenure. The scheme envisages bringing ‘Banks at the doorsteps’ of these ‘nano-entrepreneurs’ by engaging the Non-Banking Financial Companies (NBFCs) and the Micro Financing Institutions (MFIs) as lending institutions in addition to Scheduled Commercial Banks – Public & Private, Regional Rural Banks, Cooperative Banks, SHG (Self Help Group) Banks, etc. He added that the Scheme targets to help build the credit profile of the street vendors through onboarding on digital payment platforms for integrating them into the formal urban economy.

During the meeting, the minister said that a graded guarantee cover is provided, on a portfolio basis, to the lending institutions through Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) to encourage lending to street vendors. He informed that the application for a loan can be submitted through PM SVANidhi portal or Mobile App.