It might be coincidental, but the most recent economic data further supports the prevailing narrative of a potential third term for the NarendraModi government. Over the past few days, the GDP growth figures, GST collections, and the increase in forex reserves, along with the positive sentiment in the stock exchanges, all highlight the strong performance of the Modi government

KRC TIMES Desk

KRC TIMES Desk

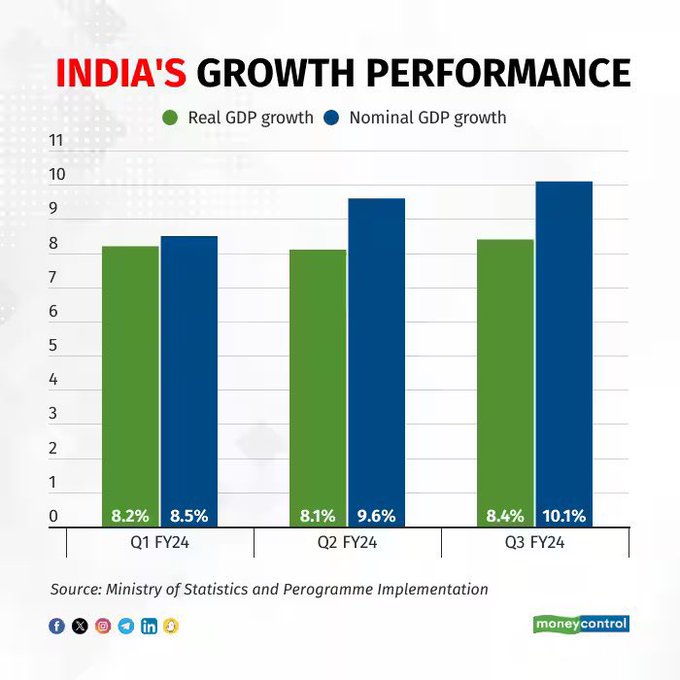

It might be coincidental, but the most recent economic data further supports the prevailing narrative of a potential third term for the Narendra Modi government. Over the past few days, the GDP growth figures, GST collections, and the increase in forex reserves, along with the positive sentiment in the stock exchanges, all highlight the strong performance of the Modi government. Despite the usual critics and nit-pickers, it is worth noting that the economy achieved a remarkable 8.4% growth in the third quarter of 2023-24, surpassing expectations and pleasantly surprising both the share markets and professional economists. The data released by the National Statistical Office last Thursday even exceeded the Reserve Bank of India’s projection of 6.5% GDP growth for the October-December period. This projection was in line with the estimates of most economists. The improved numbers in the third quarter can be attributed to growth in sectors such as manufacturing, mining, real estate construction, trade, and communications. However, some economists raised concerns about the significant difference between GDP and Gross Value Added (GVA) in the December quarter, questioning the high growth rate. GVA, which accounts for growth minus indirect taxes and subsidies on goods and services, is considered a better indicator of overall growth. In the December quarter, agriculture was the only sector that lagged behind, while all other major sectors contributed to the growth. Unlike previous quarters, both private consumption and investment showed improvement in the December quarter. The auto sector witnessed higher sales, with car sales reaching a record high. Another positive sign of economic recovery was the increase in coal production, with Coal India Ltd. reporting a 10.5% growth in production during the April-February period of the current financial year. It is no surprise that the shares of Coal India are currently trading at record highs. Additionally, the forex reserves also saw a rise of $2.9 billion in the week ending February 23, according to the latest data from the RBI.Total reserves reached $616 billion last week, but there are concerns about low household savings, consumer price inflation, and limited government funds for infrastructure projects due to increased investment in stocks. The banking sector faces liquidity shortages, expected to worsen with upcoming tax payments. On a positive note, exports have increased, benefiting from a shift away from China. Overall, the economy has recovered from Covid-19, with further growth expected after the Lok Sabha elections.