She also suggested for banks to saturate by districts, focus on a district, announce in advance by using every medium and reach out to all eligible beneficiaries of the schemes that are provided by banks, and also to take in more banking correspondents if necessary

KRC TIMES Desk

KRC TIMES Desk

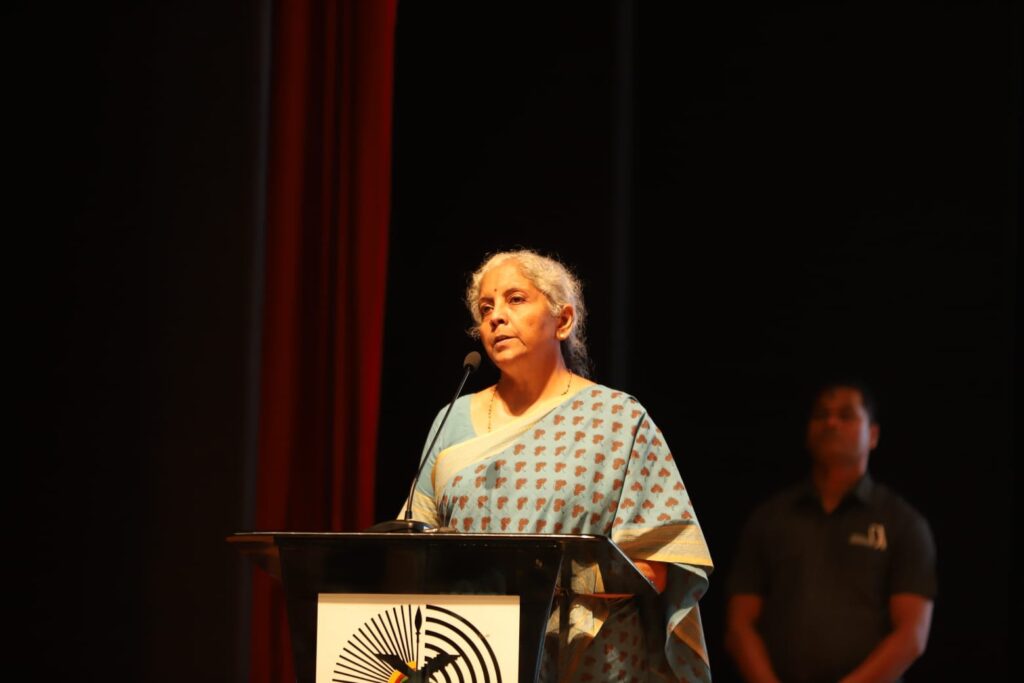

Banker’s Conclave/Credit Outreach Programme was held at the Capital Cultural Hall, Kohima on 23rd August where Union Minister, Finance and Corporate Affairs, Nirmala Sitharaman graced the programme, in the presence of Governor, Nagaland, Prof. Jagdish Mukhi, Chief Minister, Nagaland, Neiphiu Rio and his colleagues, senior government officials, and bankers.

Union Minister, Finance and Corporate Affairs, Nirmala Sitharaman stated that the Government has attempted to bring in every government schemes to be executed in such a way that all eligible citizens are covered, and in Nagaland, it is more significant because of the nature and terrain that the State is endowed with, and access being a challenge, the only way to overcome the challenge is the mobile connectivity. She stated that banks which deal with very essential financial requirements need to keep themselves adept and up to date on technologies which enable mobile banking.

Advertisements

Sitharaman highlighted the important role played by Bank Mitras in a state like Nagaland where even a block headquarters becomes difficult for villagers to reach and expressed her happiness that Bank Mitras is serving its purpose well in the State. She encouraged the banks to have a few more of them so there is greater access for the villagers.

The Finance Minister commended the State of Nagaland for performing well in schemes like Atal Pension Yojana, MUDRA and Stand Up India schemes. Sharing about Start Up schemes, she stated that the PM wants young minds in rural areas to come up with innovative ideas which can be skilled up and which will need support, for which the banks were instructed through their branches to give one SC, one ST, and a woman similar assistance which is given to Start Ups. She noted that the scheme is fairly well accomplished in Nagaland under which 523 accounts have been already given and 112 crores disbursed through loans for SCs and STs.

The Finance Minister, while noting that with 70% of the State’s population in agriculture, and Kisan Credit Card (KCC) target for Nagaland being 2.3 lakh farmers, including animal husbandry and fishery, pointed out that Nagaland has reached a target of 70,000 only. She called for more inclusion of farmers in KCC and suggested for banks go the extra mile and include those who are involved in animal husbandry. She also requested the government representatives to also help in identifying the eligible beneficiaries. She also suggested for banks to saturate by districts, focus on a district, announce in advance by using every medium and reach out to all eligible beneficiaries of the schemes that are provided by banks, and also to take in more banking correspondents if necessary.

Sitharaman set a target of outreach by the district to commence by 1st September 2022 and to conclude by 30th November 2022 for all eligible beneficiaries to avail of the benefits from the credit schemes, for which she called upon the banks to reach out, and requested the Chief Minister of Nagaland to use the State machinery to identify eligible citizens for the schemes provided.

Advertisements | 5E For Success

KRC Career Membership Program is the first step toward an evolved career-building support system powered by KRC Foundation. Ideal for students and job seekers. Mail resume to- 5eforsuccess@gmail.com